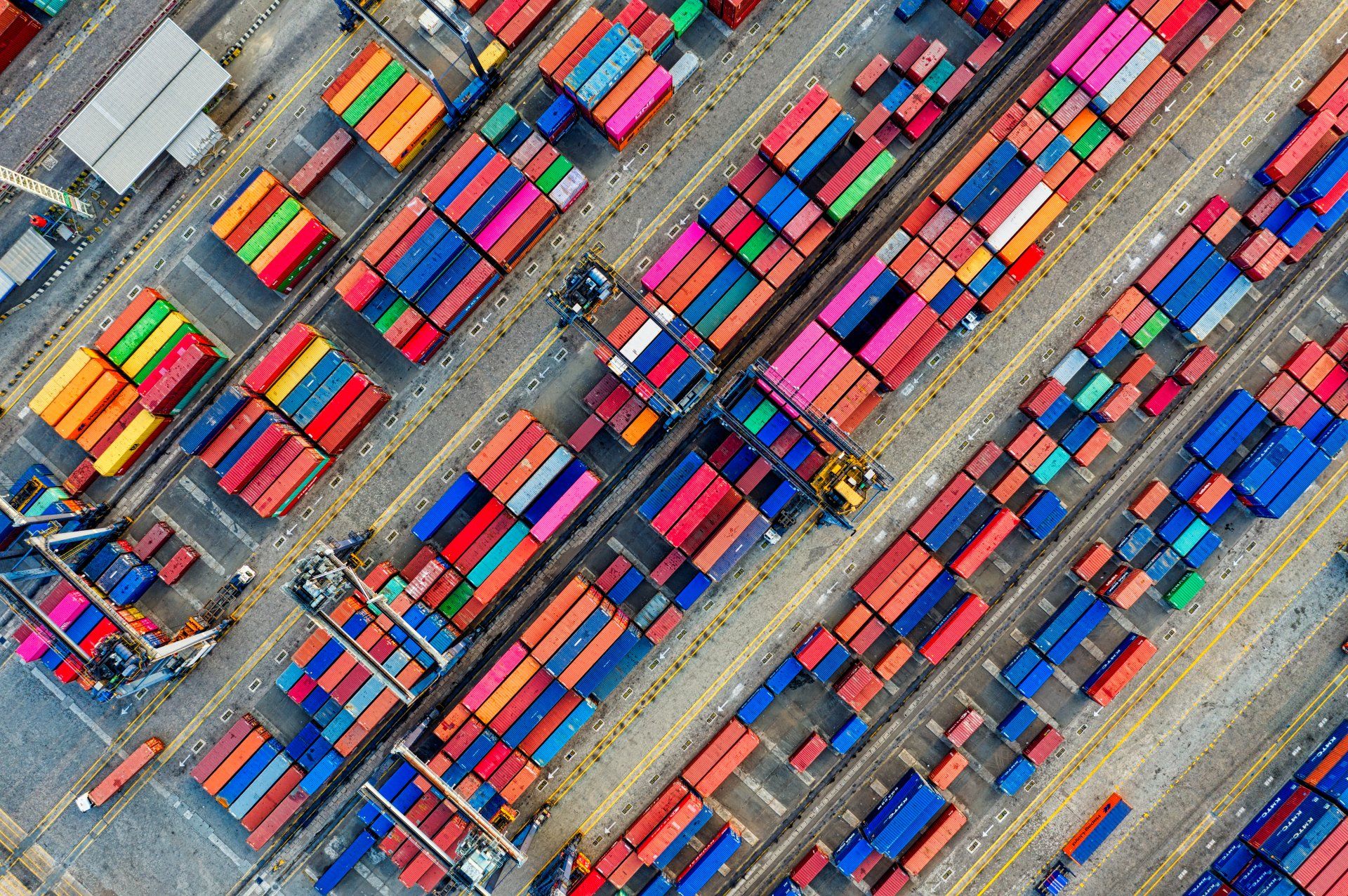

UK CBAM: What It Means for Your Business

In 2023, the UK Government announced plans to introduce a carbon border tax from 2027, known as the UK Carbon Border Adjustment Mechanism (UK CBAM).

This policy aims to prevent carbon leakage (the practice of shifting emissions-intensive production to countries with weaker climate policies) by ensuring that imported goods are subject to a comparable carbon price as those produced domestically under the UK Emissions Trading Scheme (UK ETS). Ultimately, the goal is to drive global reductions in industrial emissions and support the transition to a low-carbon economy.

What is the UK CBAM?

The UK CBAM will apply to imported goods in emissions-intensive industries. Starting in 2027, businesses importing iron, steel, aluminium, ceramics, cement, fertilisers, glass and hydrogen into the UK will be required to:

- Mandatory Disclosures: Submit reports detailing the carbon emissions embedded in their products (embodied carbon). The UK CBAM will require reporting to detail the Scope 1 (direct emissions from production), Scope 2 (indirect emissions from purchased electricity), and select precursor product emissions embodied in imported products.

- Levy Payments: Pay a levy based on the carbon pricing of the exporting country.

If the exporting country has little to no carbon pricing, UK importers will be subject to a higher tax rate. This initiative encourages businesses to source materials from suppliers with strong carbon policies, incentivising sustainable production methods.

How Will it Work?

The UK CBAM will require importers to report and pay for the emissions embedded in their products at the UK ETS carbon price. If a foreign producer has already paid a carbon price in the country of manufacture, this may be deducted from the payment charge under UK CBAM to avoid double taxation.

The UK Government has proposed to have four accounting periods per year to align with the standard practices used by other taxes.

How Does the UK CBAM Differ from the EU CBAM?

While both mechanisms share the same overarching objectives, there are key differences:

- Scope of Products: The EU CBAM applies to cement, iron, steel, aluminium, fertilisers, electricity and hydrogen, whereas the UK CBAM excludes electricity imports but also applies to additional products, such as ceramics and glass

- Implementation Timeline: The EU CBAM has already begun its transitional phase (October 1, 2023), requiring emissions reporting, with full financial enforcement starting in 2026. The UK CBAM, however, will take effect in 2027.

What Can Businesses Do to Prepare?

To limit exposure and ensure compliance with UK CBAM, businesses should take the following steps:

- Assess Supply Chains: Assess your exposure to UK CBAM by reviewing your suppliers to understand where imported products and materials are being manufactured and their carbon intensity. Identify other suppliers with lower-carbon intensities.

- Engage Key Suppliers: Work with your suppliers to encourage the adoption of low-carbon technologies and practices that will reduce the carbon intensity of manufactured materials. Consider switching suppliers and sourcing materials from UK-based companies that already comply with UK ETS, to reduce exposure.

- Comprehensive Emissions Reporting: Ensure you have sufficient emissions accounting and reporting practices in place, to minimise disruption caused by mandatory reporting. We recommend businesses understand their Scope 1, 2 & 3 emissions to identify high-impact activities and inefficiencies within their operations and their supply-chain.

How We Can Help

edenseven is a sustainability consultancy with a proven track record in designing and delivering data-driven sustainability strategies. Our cloud-based carbon accounting and management platform, cero.earth, simplifies compliance and reporting for businesses of all sizes.

Why Choose cero.earth?

- Regulatory Compliance: Aligns with the Greenhouse Gas Protocol (Scope 1, 2 & 3) to ensure accurate and compliant carbon reporting.

- Expert Support: Backed by a team of analysts who guide you through the process, making compliance straightforward.

- Seamless Data Integration: Easily upload and export data in required formats with our integrated report building tools, for effortless reporting and disclosure.

- Enhanced Credibility: Track and disclose detailed emissions data to investors and stakeholders with confidence, ensuring enhanced credibility.

- Reduce Costs: cero.earth identifies high emissions sources and inefficiencies within your operations and supply chain, enabling you to make informed decisions about where to implement impactful change, saving you cost with CBAM and ongoing operations.

- Net Zero Project Tracking: Design, implement and track your carbon-reduction projects and leverage our Net Zero Carbon (NZC) dashboard to visualize your pathway to Net Zero and set strategic carbon reduction targets.

- Flexible Packages: cero.earth offers tailored packages to suit all businesses. For businesses seeking a hands-off experience, our Strategic package allows us to handle the entire carbon accounting and compliance process on your behalf, ensuring a seamless and fully managed approach, allowing you to focus on what you do best.

Prepare Your Business for the Future

With the UK CBAM on the horizon, businesses must take proactive steps to manage their carbon impact and ensure compliance. cero.earth by edenseven, provides the tools and expertise needed to navigate these changes with ease.

Start your journey towards sustainable and compliant operations today. Get in touch today to learn more about how we can support your transition and comply with the latest sustainability regulations.